Top 10 Documents You Should Always Shred (and Why)

Top 10 Documents You Should Always Shred (and Why)

Identity theft is a growing problem that can have devastating effects on individuals and businesses alike. From stolen credit card details to fraudulent loans taken out in your name, the repercussions can linger for years. Fortunately, there’s a simple preventative measure that can help safeguard your personal information—shredding.

Whether at home or in the office, shredding sensitive documents is a crucial step to keeping your data secure. But which documents should you shred, and why should you bother?

This guide breaks it all down, highlighting the top 10 types of documents you should always shred to reduce your risk of falling victim to fraud.

Why Shredding Matters

Before jumping into the list, it’s important to understand why shredding matters. Anyone can rummage through your discarded trash to find personal information—this is called “dumpster diving.” And it’s also shockingly effective. With just a little information, criminals can gain access to your accounts, steal your identity, or even open new accounts in your name.

Shredding prevents this by turning your documents into indecipherable confetti, ensuring that your private details remain private.

Now, let’s take a closer look at which documents should always meet the shredder.

1. Credit Card Statements

Even if you’ve already paid off your bill, old credit card statements can still contain plenty of valuable data that identity thieves would love to get their hands on, including:

- Your full name

- Address

- Credit card number (sometimes partially obscured but still useful)

Before throwing them out, feed any past statements into a shredder. Better yet, opt for electronic statements through secure online banking to eliminate paper statements entirely.

2. Bank Statements

Bank statements contain highly sensitive financial data, from transaction details to account numbers. Anyone who gets access to these can attempt fraudulent transactions or steal money from your account.

Keep bank statements for a year for record-keeping purposes, but once they’re no longer needed, shred them to ensure they don’t fall into the wrong hands.

3. Tax Documents (After Their Retention Period)

Tax documents are a goldmine for criminals, containing information like Social Security numbers, income details, and addresses. The IRS recommends keeping a minimum of three years’ worth of tax returns, but anything older than that can usually be shredded. Always double-check current tax retention guidelines if you’re unsure.

Pro Tip: If you’re audited or file for refunds late, you may need to keep older tax documents for even longer. Check with your financial advisor for advice.

4. Medical Records and Bills

Medical bills and records often include sensitive personal information, including your insurance details, health conditions, and Social Security numbers. A discarded medical bill could lead to medical identity theft, allowing criminals to falsely claim treatments under your name.

To protect against this, keep medical records until they are no longer relevant, then shred them.

5. Pay Stubs

Pay stubs are another source of valuable information, often containing:

- Your full name

- Address

- Employer's information

- Salary or wages

After reconciling them with your W-2 or annual tax documents, shred old pay stubs to prevent anyone from exploiting these details.

6. Pre-Approved Credit Offers

We’ve all received those enticing pre-approved credit card or loan offers in the mail. Unfortunately, if you toss these offers in the trash without shredding, you’re handing criminals an opportunity to apply for credit in your name.

To avoid this, shred all pre-approved credit offers as soon as you’ve decided they aren’t of interest to you.

7. Utility Bills

While utility bills may seem harmless, they still contain enough personal information to pose a risk. From your full name and address to account numbers, this information can be used in phishing or impersonation scams.

Once your bills are paid and reconciled, shred them before disposal.

8. Insurance Documents (Old or Expired)

Outdated or expired insurance policies—whether health, auto, or home—should be shredded rather than dumped in the trash. These documents often include policy numbers, coverage details, and personal information that could lead to exploitation if found.Keep active policies safe and shred all expired ones to prevent misuse.

9. Receipts with Personal Information

Most of today’s receipts don’t pose much of a security risk. However, some still include vital details, such as partial debit or credit card numbers or—on occasion—your full name.

When in doubt, it’s always better to shred receipts to ensure no personal information is inadvertently exposed.

10. Old Identification Documents

Passports, driver’s licenses, social security cards—these are the holy grail for identity thieves. While you must hold onto current versions of these documents, any expired copies should be shredded immediately. Even outdated forms of identification can sometimes provide enough information for identity theft.

Be thorough when going through old files—you’d be surprised at how easily expired IDs can be overlooked.

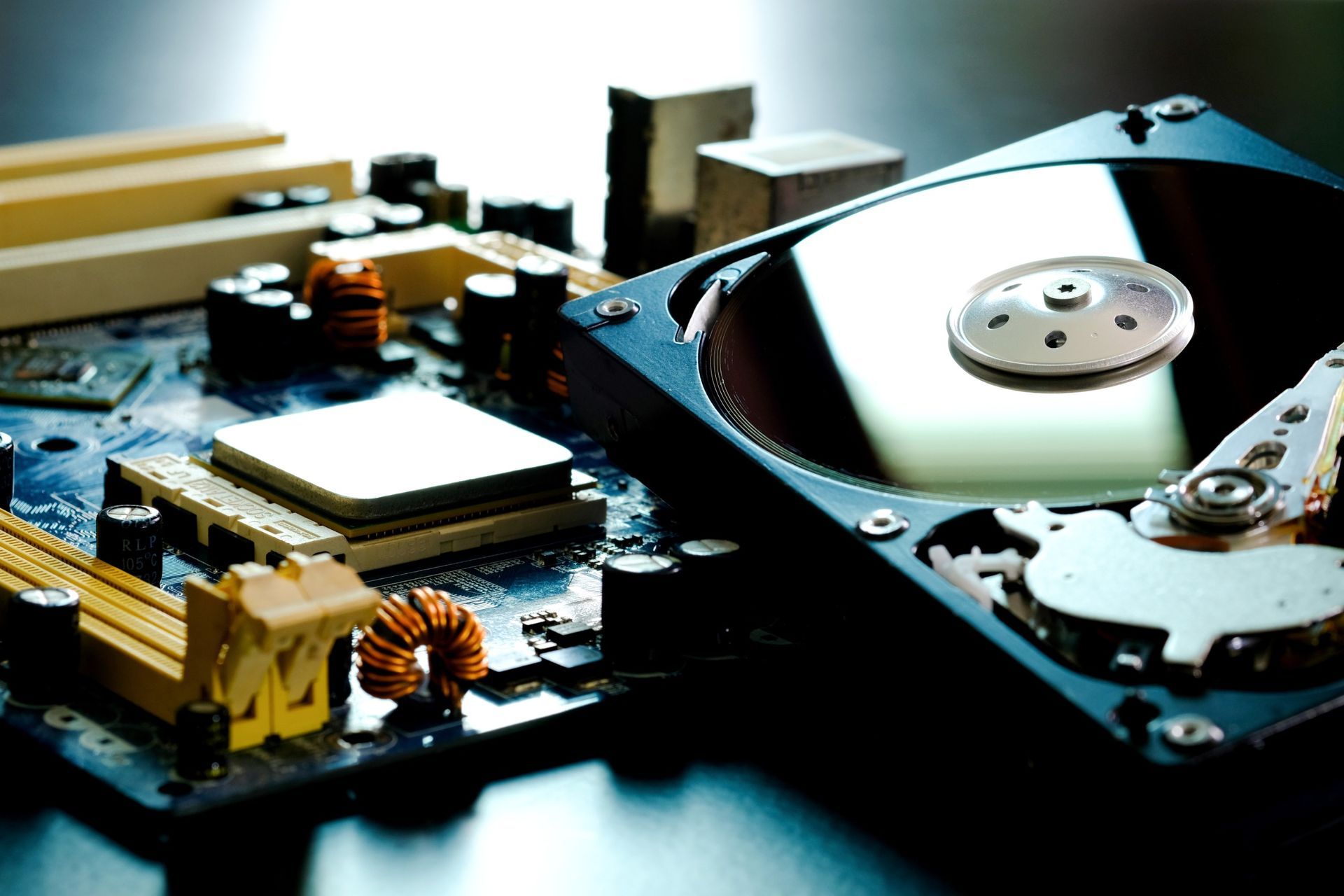

Bonus Tip: Use High-Security Shredding Services for Bulk Disposal

If you’ve gathered an enormous stack of sensitive documents that need shredding, consider using a high-security hard drive shredding service. Many companies offer services where they’ll securely collect and shred your documents for you, offering an extra layer of convenience and safety. Look for services that provide a certificate of destruction—a guarantee that your documents were securely destroyed.

Actionable Steps to Protect Your Information

Now that you know which documents to shred, here are three immediate steps you can take to safeguard your personal and financial information:

1. Invest in a Quality Shredder

Look for a cross-cut or micro-cut shredder for maximum security. These models create smaller, harder-to-reassemble pieces.

2. Go Paperless Wherever Possible

Switch to electronic statements and bills to reduce the number of sensitive documents piling up at home. Ensure your online accounts are protected with strong, unique passwords.

3. Shred Regularly

Create a habit of shredding documents weekly or monthly instead of letting them pile up. A consistent routine makes it easier to stay protected.

By being proactive with shredding, you can significantly reduce your risk of identity theft and enjoy greater peace of mind.

Are you ready to securely dispose of your personal data?

Do you have old devices lying around? Don’t wait for them to gather dust. At Data Shredder Corporation, we understand how crucial it is to destroy sensitive data securely and e-waste recycling in Massachusetts.

We're here to offer certified hard drive destruction, shredding, and secure electronics recycling services in Massachusetts, ensuring your peace of mind while contributing to the planet's health. We also provide top-notch hardware asset management services.

Your trust is our top priority, and we're dedicated to safeguarding your information with our certified, dependable solutions. Before a security breach even whispers your name, give us a call at(508) 978-1307 or fill out our

contact form.

Contact Us

40 School Street, 2nd Floor

Framingham, MA 01701

Email: service@datashredder.net

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Share On: